RALEIGH, N.C. and PANAMA CITY, Fla., Jan. 28, 2026 /PRNewswire/ — Compass Surgical Partners (Compass), a leading, independent, full-service ambulatory surgery center (ASC) development and management partner, today announced that it has partnered with local physicians to develop and…

Financial

Anteris Announces Strategic Investment from Medtronic to Continue Advancing TAVR in $320 Million Aggregate Capital Raises

MINNEAPOLIS and BRISBANE, Australia, Jan. 22, 2026 (GLOBE NEWSWIRE) — Anteris Technologies Global Corp. (Anteris or the Company) (NASDAQ: AVR, ASX: AVR) a global structural heart company committed to designing, developing, and commercializing cutting-edge medical devices to restore healthy heart function, announced today it has completed a $90 million strategic investment from Medtronic, plc (Galway, Ireland) (NASDAQ: MDT) (Medtronic), the world’s largest medical technology company. The investment closed immediately following Anteris’ underwritten offering of common stock, for a combined $320 million in gross proceeds, which supports execution of the global pivotal PARADIGM trial and advances the Company toward global commercialization of the DurAVR® Transcatheter Heart Valve (THV). Anteris and Medtronic are aligned around the belief that reshaping the Transcatheter Aortic Valve Replacement (TAVR) market requires advancing clinical science and valve design while maintaining rigorous standards for durability, hemodynamics, and long‑term patient outcomes. “This strategic investment, along with our underwritten offering of common stock, represent an important milestone for our company. It also provides strong validation of our program from the capital markets and a major strategic innovator,” said Wayne Paterson, Anteris Vice Chairman and CEO. “The investment is one aspect of a collaboration that may expand into other strategic areas in the future. Anteris has developed a clinically important, evidence-supported product designed to improve the lives of patients with aortic stenosis as we advance toward regulatory approval.” “The Board is excited to welcome Medtronic to its stockholder community,” said John Seaberg, Chairman of the Anteris Board. “This investment aligns two organizations in their commitment to advancing valve science in a way that is disciplined and focused on long‑term patient benefit.” “Medtronic is a pioneer in TAVR innovation and evidence,” said Jorie Soskin, Vice President and General Manager of the Structural Heart business in Medtronic’s Cardiovascular portfolio. “Our investment in differentiated innovation like the DurAVR® THV technology — which has the potential to offer improved valve performance in a balloon-expandable platform — is core to our commitment to define and drive the future of TAVR, meeting the needs of more aortic stenosis patients and heart teams with a comprehensive portfolio.” The Medtronic investment and the underwritten public offering of common stock position Anteris to continue to execute the global PARADIGM Trial and to continue investing in research that can transform the treatment of aortic stenosis. Wells Fargo Securities acted as sole placement agent in connection with the Medtronic investment. About the PARADIGM Trial The PARADIGM Trial is a prospective randomized controlled trial (RCT) which will evaluate the safety and effectiveness of the DurAVR® THV compared to commercially available transcatheter aortic valve replacements (TAVRs). This head-to-head study will enroll approximately 1000 patients in the ‘All Comers Randomized Cohort’ with 1:1 randomization of patients who will receive either the DurAVR® THV or TAVR using commercially available and approved THVs. The PARADIGM Trial will assess non-inferiority on a primary composite endpoint of all-cause mortality, all stroke and cardiovascular hospitalization at one year post procedure. The PARADIGM Trial has commenced recruitment with the first patients enrolled and implanted during the fourth quarter of 2025. For further information, please refer to ClinicalTrials.gov (ClinicaTrials.gov ID NCT07194265). The planned expansion across other geographies includes additional cohorts. About Anteris Anteris Technologies Global Corp. (NASDAQ: AVR, ASX: AVR) is a global structural heart company committed to designing, developing, and commercializing cutting-edge medical devices to restore healthy heart function. Founded in Australia, with a significant presence in Minneapolis, USA, Anteris is a science-driven company with an experienced team of multidisciplinary professionals delivering restorative solutions to structural heart disease patients. Anteris’ lead product, the DurAVR® Transcatheter Heart Valve (THV), was designed in partnership with the world’s leading interventional cardiologists and cardiac surgeons to treat aortic stenosis – a potentially life-threatening condition resulting from the narrowing of the aortic valve. The balloon-expandable DurAVR® THV is the first biomimetic valve, which is shaped to mimic the performance of a healthy human aortic valve and aims to replicate normal aortic blood flow. DurAVR® THV is made using a single piece of molded ADAPT® tissue, Anteris’ patented anti-calcification tissue technology. ADAPT® tissue, which is FDA-cleared, has been used clinically for over 10 years and distributed for use in over 55,000 patients worldwide. The DurAVR® THV System is comprised of the DurAVR® valve, the ADAPT® tissue, and the balloon-expandable ComASUR® Delivery System. Forward-Looking Statements This announcement contains forward-looking statements, including statements in the quotations contained herein and regarding the use of proceeds from the Private Placement and the underwritten public offering, future collaboration between the company, the PARADIGM Trial, the potential for approval of DurAVR® THV and its ability to improve the lives of patients with aortic stenosis, and the testing of the DurAVR® THV technology. Forward-looking statements include all statements that are not historical facts. Forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “budget,” “target,” “aim,” “strategy,” “plan,” “guidance,” “outlook,” “may,” “should,” “could,” “will,” “would,” “will be,” “will continue,” “will likely result” and similar expressions, although not all forward-looking statements contain these identifying words. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, including those described under “Risk Factors” in Anteris’ Annual Report on Form 10-K for the fiscal period ended December 31, 2024 and Quarterly Report on Form 10-Q for the period ended September 30, 2025, each of which was filed with the SEC and ASX. Readers are cautioned not to put undue reliance on forward-looking statements, and except as required by law, Anteris does not assume any obligation to update any of these forward-looking statements to conform these statements to actual results or revised expectations. For more information: Investor Relations Investor Relations (US)investor@anteristech.com mchatterjee@bplifescience.comDebbie Ormsby Malini Chatterjee, Ph.D.Anteris Technologies Global Corp. Blueprint Life Science Group+61 1300 550 310 | +61 7 3152 3200 +1 917 330 4269 Websitewww.anteristech.com X@AnterisTech LinkedInhttps://www.linkedin.com/company/anteristech

CORXEL Announces $287 million Series D1 Financing to Further Advance Its Cardiometabolic Pipeline including Oral Small Molecule GLP-1 Receptor Agonist

BERKELEY HEIGHTS, N.J., Jan. 22, 2026 (GLOBE NEWSWIRE) — Corxel Pharmaceuticals Limited (CORXEL), a clinical-stage biopharmaceutical company dedicated to developing innovative therapies for patients with cardiometabolic conditions around the world, today announced the successful completion of its Series D1 financing, raising up to $287 million in capital. Proceeds from the round are expected to support the advancement of CX11, a differentiated oral small molecule GLP-1 RA for obese and overweight patients currently being evaluated in a Phase 2 trial conducted by CORXEL in the United States and a Phase 3 trial conducted by Vincentage in China, and other cardiometabolic programs, including for acute ischemic stroke and hypertension.

BioAge Announces Proposed Public Offering

EMERYVILLE, Calif., Jan. 20, 2026 (GLOBE NEWSWIRE) — BioAge Labs, Inc. (Nasdaq: BIOA) (“BioAge”, “the Company”), a clinical-stage biopharmaceutical company developing therapeutic product candidates for metabolic diseases by targeting the biology of human aging, today announced a proposed underwritten public offering in which it intends to offer and sell, subject to market and other conditions, up to $75.0 million of shares of its common stock. In addition, BioAge intends to grant the underwriters a 30-day option to purchase up to an additional $11.25 million of shares of its common stock. All of the shares of common stock are being offered by BioAge. The proposed offering is subject to market and other conditions, and there can be no assurance as to whether or when the offering may be completed, or as to the actual size or terms of the offering. Goldman Sachs & Co. LLC, Piper Sandler and Citigroup are acting as joint book-running managers for the proposed offering. BioAge intends to use the net proceeds from the proposed offering, together with its existing cash, cash equivalents and marketable securities, to fund research, clinical and process development and manufacturing of its product candidates, including BGE-102 and further development of its NLRP3 and APJ programs, working capital, capital expenditures, reduction of indebtedness and for other general corporate purposes. The shares are being offered by BioAge pursuant to a registration statement on Form S-3 (No. 333-290688) that became effective on November 25, 2025. A preliminary prospectus supplement and accompanying prospectus relating to this offering will be filed with the Securities and Exchange Commission (the “SEC”). When available, copies of the preliminary prospectus supplement and the accompanying prospectus relating to this proposed offering may be obtained from Goldman Sachs & Co. LLC, Attention: Prospectus Department, 200 West Street, New York, NY 10282, by telephone at (866) 471-2526, or by email at Prospectus-ny@ny.email.gs.com; Piper Sandler & Co., Attention: Prospectus Department, 350 North 5th Street, Suite 1000, Minneapolis, MN 55401, by telephone at (800) 747-3924, or via email at prospectus@psc.com; or Citigroup Global Markets Inc., c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, by telephone at (800) 831-9146. Electronic copies of the preliminary prospectus supplement and accompanying prospectus will also be available on the SEC’s website at http://www.sec.gov. This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities of BioAge, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. About BioAge Labs, Inc. BioAge is a clinical-stage biopharmaceutical company developing therapeutic product candidates for metabolic diseases by targeting the biology of human aging. The Company’s lead product candidate, BGE-102, is a potent, orally available, brain-penetrant small-molecule NLRP3 inhibitor being developed for cardiovascular risk and retinal diseases. A Phase 1 SAD/MAD trial of BGE-102 is underway, with topline data including additional MAD cohorts anticipated in 1H26. The Company is also developing long-acting injectable and oral small molecule APJ agonists for obesity. BioAge’s additional preclinical programs, which leverage insights from the Company’s proprietary discovery platform built on human longevity data, address key pathways involved in metabolic aging. Forward-looking statements This press release contains “forward-looking statements” within the meaning of, and made pursuant to the safe harbor provisions of, the Private Securities Litigation Reform Act of 1995. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking statements, including, but not limited to, statements regarding the completion, timing of the closing and size of the underwritten offering, the grant of the option to purchase additional shares and the anticipated gross proceeds of the offering and the use thereof. These forward-looking statements may be accompanied by such words as “aim,” “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “might,” “plan,” “potential,” “possible,” “will,” “would,” and other words and terms of similar meaning. These statements involve risks and uncertainties that could cause actual results to differ materially from those reflected in such statements, including: our ability to develop, obtain regulatory approval for and commercialize our product candidates; the timing and results of preclinical studies and clinical trials; the risk that positive interim results in a preclinical study or clinical trial may not be replicated in subsequent trials or success in early stage clinical trials may not be predictive of results in later stage clinical trials; risks associated with clinical trials, including our ability to adequately manage clinical activities, unexpected concerns that may arise from additional data or analysis obtained during clinical trials, regulatory authorities may require additional information or further studies, or may fail to approve or may delay approval of our drug candidates; the occurrence of adverse safety events; failure to protect and enforce our intellectual property, and other proprietary rights; failure to successfully execute or realize the anticipated benefits of our strategic and growth initiatives; risks relating to technology failures or breaches; our dependence on collaborators and other third parties for the development of product candidates and other aspects of our business, which are outside of our full control; risks associated with current and potential delays, work stoppages, or supply chain disruptions, including due to the imposition of tariffs and other trade barriers; risks associated with current and potential future healthcare reforms; risks relating to attracting and retaining key personnel; changes in or failure to comply with legal and regulatory requirements, including shifting priorities within the U.S. Food and Drug Administration; risks relating to access to capital and credit markets; and the other risks and uncertainties that are detailed under the heading “Risk Factors” included in BioAge’s Quarterly Report on Form 10-Q filed with the U.S. Securities and Exchange Commission (SEC) on November 6, 2025, and BioAge’s other filings with the SEC filed from time to time. BioAge undertakes no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise. ContactsPR: Chris Patil, media@bioagelabs.com IR: Dov Goldstein, ir@bioagelabs.com Partnering: Peng Leong, partnering@bioagelabs.com

Major Medical Devices Appoints Healthcare Industry Veteran Eric Curtis as Its Chief Executive Officer

NEW YORK, Jan. 20, 2026 /PRNewswire/ — Major Medical Devices, Inc. (MMD) (http://www.majormedicaldevices.com) an emerging innovator in vascular intervention technologies with a highly differentiated, potentially quick to market device in a $3 billion market called abdominal aortic…

Zylox-Tonbridge to Acquire Equity Interest in A European Medical Device Company to Accelerate Expansion in the Global MedTech Market

Marks a major milestone in Zylox-Tonbridge’s long-term commitment to global expansion Builds an integrated global commercialization platform to accelerate Zylox-Tonbridge’s adoption of innovative vascular solutions worldwide Delivers Zylox-Tonbridge’s manufacturing and operational…

Boston Scientific announces agreement to acquire Penumbra, Inc.

Acquisition to expand Boston Scientific’s cardiovascular portfolio and further address increasing prevalence of vascular diseases Provides scaled entry into mechanical thrombectomy and neurovascular, key strategic adjacencies Conference call at 8:00 a.m. ET to discuss details of the transaction MARLBOROUGH, Mass. and ALAMEDA, Calif., Jan. 15, 2026 /PRNewswire/ — Boston Scientific Corporation (NYSE: BSX) and Penumbra, Inc., […]

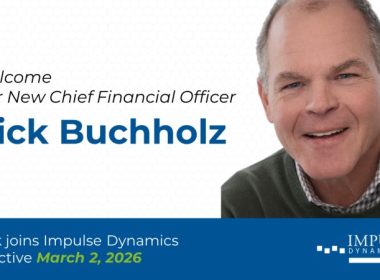

Impulse Dynamics® Announces New Chief Financial Officer

by Impulse Dynamics | Jan 13, 2026 | Press Releases MARLTON, N.J., January 13th, 2026 (GLOBE NEWSWIRE) — Impulse Dynamics®, a global medical device company committed to improving the lives of people with heart failure (HF), announced today the appointment of Richard J. Buchholz as its new Chief Financial Officer (CFO), effective March 2, 2026. “Rick […]

Abbott and AtaCor Medical Collaborate on Advanced Extravascular ICD Technology

Collaboration pairs AtaCor’s investigational extravascular ICD lead with Abbott’s investigational extravascular ICD system to deliver potentially life-saving therapies AtaCor plans to initiate a pivotal Investigational Device Exemption (IDE) clinical trial in 2026 to evaluate the investigational extravascular implantable cardioverter defibrillator (EV-ICD) system This initiative furthers Abbott’s leadership in advancing next-generation […]

Conavi Medical Corp. Announces Closing of $12M Public Offering

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES TORONTO, Jan. 13, 2026 (GLOBE NEWSWIRE) — Conavi Medical Corp. (TSXV: CNVI) (“Conavi” or the “Company”), a commercial stage medical device company focused on designing, manufacturing, and marketing imaging technologies to guide common minimally invasive cardiovascular procedures, is pleased to announce that it has closed its previously announced equity offering for aggregate gross proceeds of approximately $12 million (the “Offering”). The Company intends to use the net proceeds from the Offering to obtain US FDA 510(k) clearance of the next generation Novasight Hybrid system, as well as initiate a targeted market release in the United States. The Company also intends to use the net proceeds for working capital and other general corporate purposes. Bloom Burton Securities Inc. acted as sole and exclusive agent for the Offering. Under the Offering, subscribers purchased a total of 26,666,670 common shares of the Company (the “Common Shares”) at a price of $0.45 per Common Share, for gross proceeds of $12,000,001.50. “This Offering positions Conavi to initiate a targeted market release of Novasight, following U.S. FDA clearance,” said Tom Looby, President and Chief Executive Officer of Conavi. “The strong participation from U.S. strategic healthcare investors reflects confidence in our technology and commercial strategy, as well as growing interest in intravascular imaging technologies. The proceeds will support our commercialization efforts and continued advancement of our intravascular imaging platform.” In Canada, the Common Shares purchased pursuant to the Offering were qualified for sale by way of an amended and restated short form prospectus dated January 7, 2026, which was filed in British Columbia, Alberta and Ontario. The Common Shares were also purchased by way of private placement in the United States, pursuant to exemptions from the registration requirements under the U.S. Securities Act of 1933 (the “U.S. Securities Act”), and pursuant to all applicable U.S. state securities laws. The securities described herein have not been, and will not be, registered under the U.S. Securities Act, or any U.S. state securities laws, and accordingly, may not be offered or sold to, or for the account or benefit of, persons in the United States or to U.S. Persons (as such terms are defined in Regulation S under the U.S. Securities Act), except in compliance with the registration requirements of the U.S. Securities Act and applicable U.S. state securities requirements or pursuant to exemptions therefrom. This press release does not constitute an offer to sell or a solicitation of an offer to buy any of the Company’s securities. The Agent (together with its sub-agents) received a total cash commission of $701,479.49 and 1,558,843 compensation options of the Company (“Compensation Options”). Each Compensation Option entitles the holder to buy one Common Share at a price of $0.45 per Common Share until expiry on January 13, 2028. About Conavi Medical Conavi Medical is focused on designing, manufacturing, and marketing imaging technologies to guide common minimally invasive cardiovascular procedures. Its patented Novasight Hybrid™ System is the first to combine intravascular ultrasound (IVUS) and optical coherence tomography (OCT) into a single device, enabling simultaneous and co-registered imaging of coronary arteries. The first-generation Novasight Hybrid™ System has 510(k) regulatory clearance in the U.S., Canada, China, and Japan. For more information, visit http://www.conavi.com. CONTACT: Chief Financial Officer: Mark Quick, 416-483-0100 Investors: Christina Cameron, 416-483-0100 ext.121, IR@conavi.com Notice on forward-looking statements: This press release includes forward-looking information or forward-looking statements within the meaning of applicable securities laws regarding Conavi and its business, which may include, but are not limited to, statements with respect to the anticipated use of proceeds from the Offering. All statements that are, or information which is, not historical facts, including without limitation, statements regarding future estimates, plans, programs, forecasts, projections, objectives, assumptions, expectations or beliefs of future performance, are “forward-looking information or statements”. Often but not always, forward-looking information or statements can be identified by the use of words such as “shall”, “intends”, “anticipate”, “believe”, “plan”, “expect”, “intend”, “estimate” “anticipate” or any variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may”, “might”, “can”, “could”, “would” or “will” be taken, occur, lead to, result in, or, be achieved. Such statements are based on the current expectations and views of future events of the management of the Company. They are based on assumptions and subject to risks and uncertainties. Although management believes that the assumptions underlying these statements are reasonable, they may prove to be incorrect. The forward-looking events and circumstances discussed in this release, may not occur and could differ materially as a result of known and unknown risk factors and uncertainties affecting the Company, including, without limitation, those listed in the “Risk Factors” section of the amended and restated short form prospectus dated January 7, 2026 and the joint information circular of the Company dated August 30, 2024 (both of which are on the Company’s profile at www.sedarplus.ca). Although Conavi has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on any forward-looking statements or information. No forward-looking statement can be guaranteed. Except as required by applicable securities laws, forward-looking statements speak only as of the date on which they are made and Conavi does not undertake any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise. No regulatory authority has approved or disapproved the content of this press release. Neither the TSX Venture Exchange nor its Regulatory Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.