Presentation to provide comprehensive overview of AVIM Therapy clinical evidence demonstrating the potential to halt the progression of hypertensive heart diseaseOrchestra BioMed and Medtronic (NYSE: MDT) have a strategic collaboration to develop and commercialize AVIM Therapy for the treatment of uncontrolled hypertension in patients indicated for a pacemaker, an estimated global population of over 750,000 patients annuallyAVIM Therapy has received FDA Breakthrough Device Designation for the treatment of uncontrolled hypertension in patients with increased cardiovascular risk, an estimated U.S. population of over 7.7 million patients NEW HOPE, Pa., Oct. 09, 2025 (GLOBE NEWSWIRE) — Orchestra BioMed Holdings, Inc. (Nasdaq: OBIO, “Orchestra BioMed” or the “Company”), a biomedical company accelerating high-impact technologies to patients through strategic partnerships with market-leading global medical device companies, today announced a data summary supporting the transformative potential of Atrioventricular Interval Modulation (“AVIM”) Therapy in the management of hypertensive heart disease will be presented in a keynote talk at the Georgia Innovation Summit in Tbilisi, Georgia on October 10, 2025. The presentation, to be delivered by Avi Fischer, MD, Senior Vice President of Medical Affairs and Innovation at Orchestra BioMed, will showcase AVIM Therapy as a novel, device-based therapeutic approach targeting hypertensive heart disease progression and its potential to redefine standards of care. Dr. Fischer commented, “This keynote presentation reflects the growing global recognition of AVIM Therapy as a novel, device-based therapy, poised to reshape the future of hypertension care. Hypertension is the principal driver of diastolic dysfunction, which accelerates the development of heart failure. Despite widespread use of antihypertensive therapies, many patients continue to progress along the disease pathway, underscoring the importance of novel therapeutic approaches. The collective body of AVIM Therapy clinical data demonstrates its potential to directly modulate the progression of hypertensive heart disease, offering the potential to intervene earlier in the course of the disease to improve long-term outcomes, transform patient care, and ultimately create lasting value for all stakeholders.” The keynote presentation will provide a comprehensive overview of clinical and mechanistic AVIM Therapy results from pilot and long-term follow-up studies, highlighting the therapy’s consistent favorable clinical impact on blood pressure and cardiac function: Immediate, substantial, and sustained blood pressure reduction MODERATO I pilot study: 24-hour ambulatory systolic blood pressure (“aSBP”) reduced by 11.6 mmHg at 1 day and 10.1 mmHg at 3 monthsMODERATO II pilot study: 24-hour aSBP reduced by 15.6 mmHg at 1 day and 11.1 mmHg at 6 months, as well as an office systolic blood pressure reduction of 17.5 mmHg at 24 months Favorable impact on cardiac hemodynamics after 24 months of treatment (MODERATO I) Significant reductions in heart rate and end-diastolic volumeNo significant changes in end-systolic volume or ejection fraction, supporting safety Improvement in echocardiographic measures of diastolic function (MODERATO II) Significant increases in e’ and E/A ratio, indicating improved myocardial relaxation and diastolic compliance Potential to halt hypertensive heart disease progression Long-term follow-up demonstrates sustained blood pressure reduction with reversibility of effect and absence of rebound hypertension upon deactivationFavorable effects were reproducible after a 7-day washout period followed by reactivation, underscoring durability and reliability About Orchestra BioMed Orchestra BioMed (Nasdaq: OBIO) is a biomedical innovation company accelerating high-impact technologies to patients through risk-reward sharing partnerships with leading medical device companies. Orchestra BioMed’s partnership-enabled business model focuses on forging strategic collaborations with leading medical device companies to drive successful global commercialization of products it develops. Orchestra BioMed’s lead product candidate is atrioventricular interval modulation (AVIM) therapy (also known as BackBeat Cardiac Neuromodulation Therapy (CNT™)) for the treatment of hypertension, the leading risk factor for death worldwide. Orchestra BioMed is also developing the Virtue® Sirolimus AngioInfusion™ Balloon (SAB) for the treatment of atherosclerotic artery disease, the leading cause of mortality worldwide. Orchestra BioMed has a strategic collaboration with Medtronic, one of the largest medical device companies in the world, for development and commercialization of AVIM Therapy for the treatment of hypertension in pacemaker-indicated patients, and a strategic partnership with Terumo, a global leader in medical technology, for development and commercialization of Virtue SAB for the treatment of artery disease. For further information about Orchestra BioMed, please visit www.orchestrabiomed.com, and follow us on LinkedIn. References to Websites and Social Media Platforms References to information included on, or accessible through, websites and social media platforms do not constitute incorporation by reference of the information contained at or available through such websites or social media platforms, and you should not consider such information to be part of this press release. About AVIM Therapy AVIM Therapy is an investigational therapy compatible with standard dual-chamber pacemakers designed to substantially and persistently lower blood pressure. It has been evaluated in pilot studies in patients with hypertension who are also indicated for a pacemaker. MODERATO II, a double-blind, randomized pilot study, showed that patients treated with AVIM Therapy experienced net reductions of 8.1 mmHg in 24-hour ambulatory systolic blood pressure (aSBP) and 12.3 mmHg in office systolic blood pressure (oSBP) at six months when compared to control patients. In addition to reducing blood pressure, clinical results using AVIM Therapy demonstrate improvements in cardiac function and hemodynamics. The BACKBEAT (BradycArdia paCemaKer with atrioventricular interval modulation for Blood prEssure treAtmenT) global pivotal study will evaluate the safety and efficacy of AVIM Therapy in lowering blood pressure in patients who have systolic blood pressure above target despite anti-hypertensive medication and who are indicated for or have recently received a dual-chamber cardiac pacemaker. AVIM Therapy has been granted Breakthrough Device Designation by the FDA for the treatment of uncontrolled hypertension in patients who have increased cardiovascular risk. Forward-Looking StatementsCertain statements included in this press release that are not historical facts are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements relating to the implementation and design of the BACKBEAT pivotal study, the potential efficacy and safety of the Company’s commercial product candidates, the ability of the Company’s partnerships to accelerate clinical development, and the Company’s late-stage development programs and strategic partnerships. These statements are based on various assumptions, whether or not identified in this press release, and on the current expectations of the Company’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on as a guarantee, an assurance, a prediction, or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and may differ from assumptions. Many actual events and circumstances are beyond the control of the Company. These forward-looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political, and legal conditions; risks related to regulatory approval of the Company’s product candidates and ongoing regulation of the Company’s product candidates, if approved; the timing of, and the Company’s ability to achieve, expected regulatory and business milestones; the impact of competitive products and product candidates; and the risk factors discussed under the heading “Item 1A. Risk Factors” in the Company’s annual report on Form 10-K for the year ended December 31, 2024, which was filed with the Securities and Exchange Commission on March 31, 2025, as updated by any risk factors disclosed under the heading “Item 1A. Risk Factors” in the Company’s subsequently filed quarterly reports on Form 10-Q. The Company operates in a very competitive and rapidly changing environment. New risks emerge from time to time. Given these risks and uncertainties, the Company cautions against placing undue reliance on these forward-looking statements, which only speak as of the date of this press release. The Company does not plan and undertakes no obligation to update any of the forward-looking statements made herein, except as required by law. Investor ContactSilas NewcombOrchestra BioMedSnewcomb@orchestrabiomed.com Media ContactKelsey Kirk-EllisOrchestra BioMedKkirkellis@orchestrabiomed.com

Author: Ken Dropiewski

Akero Therapeutics to be Acquired by Novo Nordisk for up to $5.2 Billion

Shareholders to Receive $54 Per Share in Cash and CVR of $6 Per Share Advances Akero’s Mission of Bringing Novel Therapies to Patients with High Unmet Medical Needs SOUTH SAN FRANCISCO, Calif., Oct. 09, 2025 (GLOBE NEWSWIRE) — Akero Therapeutics, Inc. (“Akero”) (Nasdaq: AKRO), a clinical-stage company developing transformational treatments for patients with serious metabolic diseases marked by high unmet medical need, today announced that it has entered into a definitive agreement to be acquired by Novo Nordisk A/S (“Novo Nordisk”) for up to $5.2 billion in cash. Under the terms of the agreement, Akero shareholders will receive $54.00 per share in cash at closing and a non-transferable Contingent Value Right (“CVR”). Each CVR will entitle its holder to receive a cash payment of $6.00 per share upon full U.S. regulatory approval of efruxifermin (“EFX”) for treatment of compensated cirrhosis due to MASH by June 30, 2031. The upfront cash portion of the consideration represents an equity value of approximately $4.7 billion, a 19% premium to Akero’s 30-day Volume Weighted Average Price (VWAP), and a 42% premium to Akero’s closing price on May 19, 2025 prior to market speculation. Combined, the upfront and potential contingent value payment represent, if achieved, an equity value of approximately $5.2 billion, a 32% premium to Akero’s 30-day VWAP, and a 57% premium to Akero’s closing price on May 19, 2025 prior to market speculation. Akero’s innovative EFX program – focused on developing a best-in-class treatment for metabolic dysfunction-associated steatohepatitis (“MASH”) – will complement Novo Nordisk’s leadership in GLP-1 based metabolic treatments. Novo Nordisk’s world leading capabilities in cardio-metabolic disease will enhance and accelerate evaluation of EFX in the Phase 3 SYNCHRONY program, preparation for a successful commercial launch, and delivery of EFX to patients in need around the globe. “We are excited to enter into this transaction with Novo Nordisk, which follows a comprehensive review undertaken by our Board of Directors, delivers meaningful value to Akero shareholders, and positions us to expand treatment options for people around the globe through Novo Nordisk’s industry-leading development capabilities and commercial infrastructure,” said Andrew Cheng, M.D., Ph.D, President and CEO of Akero Therapeutics. “I want to thank Akero’s talented employees for their tireless commitment to advancing EFX and meeting a critical global unmet need. We look forward to joining the Novo Nordisk family and accelerating the momentum of EFX to deliver a transformational impact on patients’ lives.” The transaction has been unanimously approved by Akero’s Board of Directors and is expected to close around year-end, subject to approval by Akero shareholders and upon satisfaction of customary closing conditions including approvals by regulatory authorities. Morgan Stanley & Co. LLC and J.P. Morgan Securities LLC are serving as financial advisors to Akero Therapeutics, and Kirkland & Ellis LLP as its legal advisor. About Akero TherapeuticsAkero Therapeutics is a clinical-stage company developing transformational treatments for patients with serious metabolic diseases marked by high unmet medical need, including metabolic dysfunction-associated steatohepatitis (MASH). Akero’s lead product candidate, efruxifermin (EFX), is currently being evaluated in three ongoing Phase 3 clinical studies: SYNCHRONY Histology in patients with pre-cirrhotic (F2-F3 fibrosis) MASH, SYNCHRONY Outcomes in patients with compensated cirrhosis (F4) due to MASH, and SYNCHRONY Real-World in patients with MASH or MASLD (metabolic dysfunction-associated steatotic liver disease). The Phase 3 SYNCHRONY program builds on the results of two Phase 2b clinical trials, the HARMONY study in patients with pre-cirrhotic MASH and the SYMMETRY study in patients with compensated cirrhosis due to MASH. Akero is headquartered in South San Francisco. Visit us at Akerotx.com and follow us on LinkedIn and X for more information. About Novo NordiskNovo Nordisk is a leading global healthcare company founded in 1923 and headquartered in Denmark. Our purpose is to drive change to defeat serious chronic diseases built upon our heritage in diabetes. We do so by pioneering scientific breakthroughs, expanding access to our medicines and working to prevent and ultimately cure disease. As of August 2025, Novo Nordisk employed about 78,400 people in 80 countries and markets its products in around 170 countries. Novo Nordisk’s B shares are listed on Nasdaq Copenhagen (NOVO-B). Its ADRs are listed on the New York Stock Exchange (NVO). For more information, visit novonordisk.com, Facebook, Instagram, X, LinkedIn and YouTube. About EFX and the SYNCHRONY programEFX, Akero’s lead product candidate, is currently being evaluated in three ongoing phase 3 trials. In multiple phase 2 trials, EFX has been observed to reverse fibrosis (including compensated cirrhosis), resolve MASH, reduce non-invasive markers of fibrosis and liver injury, and improve insulin sensitivity and lipoprotein profile. This holistic profile offers the potential to address the complex, multi-system disease state of all stages of MASH, including improvements in risk factors linked to cardiovascular disease – the leading cause of death among MASH patients. Engineered to mimic the biological activity profile of native FGF21, EFX is designed to offer once-weekly subcutaneous dosing and has been generally well-tolerated in clinical trials to date. The ongoing global phase 3 SYNCHRONY program (total ~3,500 participants) is comprised of three, randomized, placebo-controlled trials evaluating the efficacy and safety of EFX in both compensated cirrhosis (F4) due to MASH and pre-cirrhotic (F2-F3) MASH. SYNCHRONY Real-World, assessing the safety and tolerability of EFX (50 mg) in patients with noninvasively diagnosed MASH or metabolic dysfunction-associated steatotic liver disease (MASLD) (F1-F4).SYNCHRONY Histology, evaluating the efficacy and safety of EFX (28 mg and 50 mg) in patients with biopsy-confirmed pre-cirrhotic (F2-F3) MASH.SYNCHRONY Outcomes, evaluating the efficacy and safety of EFX (50 mg) for the treatment of compensated cirrhosis (F4) due to MASH. Important Information and Where to Find ItIn connection with the proposed transaction between Akero Therapeutics, Inc. (“Akero”) and Novo Nordisk A/S (“Parent”), Akero intends to file with the Securities and Exchange Commission (“SEC”) a proxy statement (the “Proxy Statement”), the definitive version of which will be sent or provided to Akero stockholders. Akero may also file other documents with the SEC regarding the proposed transaction. This document is not a substitute for the Proxy Statement or any other document which Akero may file with the SEC. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the Proxy Statement (when it is available) and other documents that are filed or will be filed with the SEC by Akero through the website maintained by the SEC at www.sec.gov, Akero’s website at https://ir.akerotx.com/financial-information/sec-filings or by contacting the Akero investor relations department at the following: Christina Tartaglia (212) 362-1200 IR@akerotx.com Participants in the SolicitationThis communication does not constitute a solicitation of a proxy, an offer to purchase or a solicitation of an offer to sell any securities. Akero and certain of its directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding Akero’s directors and executive officers, including a description of their direct interests, by security holdings or otherwise, is contained in (i) the “Directors, Executive Officers and Corporate Governance,” “Executive Compensation” and “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” sections of the Annual Report on Form 10-K for the fiscal year ended December 31, 2024 of Akero, which was filed with the SEC on February 28, 2025 and (ii) the “Proposal 1 – Election of Class III Directors,” “Executive Compensation,” and “Principal Stockholders” sections of Akero’s proxy statement for its 2025 annual meeting of stockholders, which was filed with the SEC on April 28, 2025, and will be contained in the proxy statement to be filed by Akero in connection with the proposed transaction. Any change of the holdings of Akero’s securities by its directors or executive officers from the amounts set forth in the proxy statement for its 2025 annual meeting of stockholders have been reflected in the following Statements of Changes in Beneficial Ownership on Form 4 filed with the SEC: by Jonathan Young, filed on October 3, 2025, September 12, 2025, September 4, 2025, August 13, 2025, July 2, 2025, June 20, 2025 and June 12, 2025; by Catriona Yale, dated September 12, 2025, July 18, 2025, July 2, 2025, June 20, 2025, June 20, 2025, June 12, 2025 and May 19, 2025; by Richard William White, dated September 12, 2025, July 2, 2025, June 20, 2025 and June 12, 2025; by Timothy Rolph, dated September 12, 2025, September 10, 2025, August 7, 2025, July 9, 2025, July 2, 2025, June 20, 2025, June 12, 2025, June 9, 2025, May 8, 2025 and April 28, 2025; by Andrew Cheng, dated September 12, 2025, August 13, 2025, July 11, 2025, July 2, 2025, June 20, 2025, June 12, 2025 and May 13, 2025; by Scott Gangloff, dated August 19, 2025, July 2, 2025 and June 20, 2025; by Jane Henderson, dated August 12, 2025 and June 5, 2025; by Patrick Lamy, dated July 3, 2025, July 2, 2025, June 20, 2025, June 20, 2025, June 12, 2025, June 4, 2025, May 23, 2025 and May 9, 2025; by Mark T. Iwicki, dated June 5, 2025; by Seth Loring Harrison, dated June 5, 2025; by Yuan Xu, dated June 5, 2025; by Tomas J. Heyman, dated June 5, 2025; by Judy Chou, dated June 5, 2025; and by Graham G. Walmsley, dated June 5, 2025. Akero stockholders may obtain additional information regarding the direct and indirect interests of the participants in the solicitation of proxies in connection with the proposed transaction, including the interests of Akero directors and executive officers in the transaction, which may be different than those of Akero stockholders generally, by reading the Proxy Statement and any other relevant documents that are filed or will be filed with the SEC relating to the transaction. These documents (when available) may be obtained free of charge from the website maintained by the SEC at www.sec.gov and Akero’s website at https://ir.akerotx.com/financial-information/sec-filings. Forward-Looking Statements DisclaimerThis communication contains forward-looking statements related to Akero, Parent and the proposed acquisition of Akero by Parent (the “Transaction”) that involve substantial risks and uncertainties. Forward-looking statements include any statements containing the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “goal,” “may,” “might,” “plan,” “predict,” “project,” “seek,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue” and similar expressions. In this communication, Akero’s forward-looking statements include statements about the parties’ ability to satisfy the conditions to the consummation of the Transaction; statements about the expected timetable for completing the transaction; Akero’s plans, objectives, expectations and intentions, the financial condition, results of operations and business of Akero, the U.S. Food and Drug Administration’s approval of Akero’s new drug application for efruxifermin for the treatment of metabolic dysfunction-associated steatohepatitis, Akero’s ability to commercialize current and future product candidates, and the anticipated timing of closing of the Transaction. Forward-looking statements are subject to certain risks, uncertainties, or other factors that are difficult to predict and could cause actual events or results to differ materially from those indicated in any such statements due to a number of risks and uncertainties. Those risks and uncertainties that could cause the actual results to differ from expectations contemplated by forward-looking statements include, among other things: uncertainties as to the ability to obtain shareholder approval; risks related to non-achievement of the CVR milestones and that holders of the CVRs will not receive any payments in respect of those CVRs; the possibility that competing offers will be made; the possibility that various closing conditions for the Transaction may not be satisfied or waived, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the Transaction; the effects of the Transaction on relationships with employees, other business partners or governmental entities; the difficulty of predicting the timing or outcome of FDA approvals or actions, if any; the impact of competitive products and pricing; that Parent may not realize the potential benefits of the Transaction; other business effects, including the effects of industry, economic or political conditions outside of the companies’ control; transaction costs; actual or contingent liabilities; and other risks listed under the heading “Risk Factors” in Akero’s periodic reports filed with the U.S. Securities and Exchange Commission, including quarterly reports on Form 10-Q and annual reports on Form 10-K. These risks, as well as other risks associated with the proposed transaction, are more fully discussed in the Proxy Statement to be filed with the U.S. Securities and Exchange Commission in connection with the proposed transaction. While the list of factors presented here is, and the list of factors presented in the Proxy Statement will be, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. You should not place undue reliance on these statements. All forward-looking statements are based on information currently available to Akero and Parent, and Akero and Parent disclaim any obligation to update the information contained in this communication as new information becomes available. Investor Contact:Christina TartagliaPrecision AQ(212) 362-1200IR@akerotx.com Media Contact:Jamie Moser / Andrew SiegelJoele Frank, Wilkinson Brimmer Katcher(212) 355-4449

Penumbra, Inc. Schedules Investor Event at TCT Conference on October 26, 2025; Earnings Release and Conference Call for Third Quarter 2025 Scheduled for November 5, 2025

ALAMEDA, Calif., Oct. 8, 2025 /PRNewswire/ — Penumbra, Inc. (NYSE: PEN) today announced that it will host an investor event on Sunday, October 26, 2025 from 4:00-5:00 PM Pacific Time / 7:00-8:00 PM Eastern Time at the 2025 Transcatheter Cardiovascular Therapeutics (TCT) Conference….

Prytime Medical Devices Receives World’s First Extended Duration FDA 510(k) Clearance for pREBOA-PRO™ Catheter

BOERNE, Texas, Oct. 8, 2025 /PRNewswire/ — Building once again on their first mover position as a leader in endovascular hemorrhage control and resuscitation, Prytime Medical Devices, Inc. (Prytime) this week announced a new FDA 510(k) clearance for their flagship pREBOA-PRO™ Catheter….

SQ Innovation Announces FDA Approval of Lasix® ONYU for Treatment of Edema in Heart Failure

Second-generation delivery device offers cost-effective alternative to hospital care benefiting patients, providers and payors Worsening heart failure is among the top three indications for hospitalizations in the elderly BURLINGTON, Mass., Oct. 8, 2025 /PRNewswire/ — SQ Innovation, Inc….

Pulse Biosciences Announces Clinical Data Highlighting its nPulse™ Cardiac Surgical System to be Presented at the 39th European Association for Cardio-Thoracic Surgery Annual Meeting

HAYWARD, Calif.–(BUSINESS WIRE)–Pulse Biosciences, Inc. (Nasdaq: PLSE), a company leveraging its novel nPulse™ technology using its proprietary Nanosecond Pulsed Field Ablation™ (nanosecond PFA or nsPFA™) energy, today announced the upcoming presentation of early clinical data on the treatment of atrial fibrillation (AF) using the nPulse™ Cardiac Surgical System at the […]

Vensana Capital Launches Vensana Innovation and Adds Thomas Tu, MD, as Venture Partner

Firm launches innovation engine dedicated to medical technology company building The effort will be led by the firm’s new Venture Partner Thomas Tu, MD MINNEAPOLIS & WASHINGTON–(BUSINESS WIRE)–Vensana Capital (“Vensana”), a leading venture capital and growth equity investment firm dedicated to medical technology, today announced the launch of Vensana Innovation (“VI”), a medtech […]

Cagent Vascular Expands Serranator Product Line with Launch of 7.0 mm and 8.0 mm Sizes

New larger diameters broaden treatment options for physicians managing complex peripheral artery disease WAYNE, Pa.–(BUSINESS WIRE)–Cagent Vascular, a leader in innovative endovascular technologies, today announced the commercial launch of the Serranator® PTA Serration Balloon Catheter in 7.0 mm and 8.0 mm diameters. This expansion brings the proven benefits of serration […]

Jupiter Endovascular Closes Oversubscribed Series B Financing, Surpassing $40 Million Target

Round Led by Sonder Capital with Participation from Senvest Management, LB Investment, and a New Strategic Corporate Investor MENLO PARK, Calif. – October 7, 2025 – Jupiter Endovascular, Inc., a medical technology startup developing a new class of endovascular procedures using its proprietary Transforming Fixation (TFX) technology, today announced it has […]

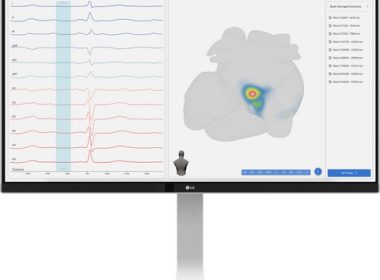

Vektor Medical Secures CE Mark for vMap, Bringing the Benefits of Non-Invasive Arrhythmia Mapping to Europe

SAN DIEGO–(BUSINESS WIRE)–Vektor Medical, a medical technology company transforming cardiac arrhythmia care, announced it has received CE Mark for the vMap® System, a non-invasive tool developed with AI that transforms standard 12-lead ECG data into 3D arrhythmia source maps in under a minute. “vMap is emerging as a simple, non-invasive […]