WAYNE, Pa., July 01, 2025 (GLOBE NEWSWIRE) — Teleflex Incorporated (NYSE:TFX), a leading global provider of medical technologies, today announced that it has completed the previously announced acquisition of substantially all of the Vascular Intervention business of BIOTRONIK SE & Co. KG. The acquisition adds a broad portfolio of therapeutic products to Teleflex’s portfolio of interventional access products, driving an enhanced global presence in the cath lab. The Vascular Intervention business will also establish Teleflex’s global footprint in the fast-growing peripheral intervention market, and provide a channel for Teleflex products that currently have a peripheral indication.

Financial

JLL Partners Announces Investment in Vascular Technology, Incorporated

Greg Groenke Appointed CEO; Lars Marcher Named Executive Chairman NEW YORK–(BUSINESS WIRE)–JLL Partners (“JLL” or the “Firm”), a New York-based middle market private equity firm focused on investing in the healthcare, aerospace and defense, and business services sectors, today announced its investment in Vascular Technology, Incorporated (“VTI” or the “Company”), a […]

BridgeBio Raises $300 Million Through Partial Capped Monetization of BEYONTTRA® European Royalty

BridgeBio has received a $300 million upfront payment, strengthening the Company’s balance sheet, and supporting the launch of Attruby® and ongoing late-stage pipeline programsTransaction monetizes 60% of BridgeBio’s European royalties on the first $500 million of annual BEYONTTRA net sales, with total payments to the investors subject to an initial cap of 1.45xIn the ATTRibute-CM study, acoramidis demonstrated the most rapid benefit seen in any Phase 3 study of ATTR-CM to date in both ATTRv-CM and ATTRwt-CM patients: In as few as 3 months, the time to first event (ACM or CVH) durably separated relative to placeboA 42% reduction in composite ACM and recurrent CVH events relative to placebo at Month 30A 50% reduction in the cumulative frequency of CVH events relative to placebo at Month 30 Acoramidis is approved as Attruby by the U.S. FDA and is approved as BEYONTTRA by the European Commission, Japanese Pharmaceuticals and Medical Devices Agency and UK Medicines and Healthcare Products Regulatory Agency PALO ALTO, Calif., June 30, 2025 (GLOBE NEWSWIRE) — BridgeBio Pharma, Inc. (Nasdaq: BBIO) (“BridgeBio” or the “Company”), a new type of biopharmaceutical company focused on genetic diseases, today announced it has sold a portion of royalties due to the Company from sales of BEYONTTRA in Europe to HealthCare Royalty (“HCRx”) and funds managed by Blue Owl Capital (“Blue Owl”) for $300 million. This royalty financing agreement monetizes select anticipated royalties and provides immediate less-dilutive capital to the Company. “We’re excited to partner with HCRx and Blue Owl to strengthen our balance sheet in support of the launch of Attruby and our pipeline of first and best-in-class genetic medicines. This transaction preserves significant upside for our shareholders, with careful structuring that limits annual as well as total payments made to the royalty investors. This financing highlights the strong early start and large global potential of acoramidis,” said Chinmay Shukla, Senior Vice President of Strategic Finance at BridgeBio. Clarke Futch, Chairman and Chief Executive Officer of HCRx commented: “We have been following the progress of acoramidis for years and strongly believe in its potential to positively impact the lives of patients living with ATTR-CM. This investment exemplifies HCRx’s commitment to supporting innovation in the biopharmaceutical industry and we are pleased to collaborate with BridgeBio on this transaction.” “We are pleased to continue our support of BridgeBio through this royalty monetization transaction,” said Sandip Agarwala, Managing Director and Head of Life Sciences at Blue Owl. “This investment reflects our confidence in BEYONTTRA commercial potential and our commitment to providing flexible capital solutions that help advance life-saving therapies.” Under the terms of the agreement, BridgeBio has received $300 million from HCRx and Blue Owl managed funds in exchange for 60% of royalties on the first $500 million of annual BEYONTTRA net sales in Europe. The agreement includes an initial cap of 1.45x. Once the applicable cap is met, no further payments will be owed to the investors. In March 2024, BridgeBio entered into an exclusive licensing agreement with Bayer Consumer Care AG to commercialize BEYONTTRA in Europe for the treatment for ATTR‑CM. To date, BridgeBio has received $210 million in upfront and regulatory milestones, and anticipates receiving a further $75 million in near-term milestone payments, along with tiered royalties starting in the low‑30% range on net sales of BEYONTTRA in Europe. Acoramidis is approved in the U.S. as Attruby by the FDA and in Europe as BEYONTTRA by the European Commission. It is also approved as BEYONTTRA by the Japanese Pharmaceuticals and Medical Devices Agency, and UK Medicines and Healthcare Products Regulatory Agency with all labels specifying near-complete stabilization of TTR. Latham & Watkins LLP served as legal advisor to BridgeBio. Gibson, Dunn & Crutcher LLP served as legal advisor to HCRx and Blue Owl. About BEYONTTRABEYONTTRA is an orally administered near-complete (≥90%) stabilizer of transthyretin (TTR) indicated for the treatment of wild-type or variant transthyretin amyloidosis in adult patients with cardiomyopathy (ATTR-CM). For full prescribing information, please refer to the Summary of Product Characteristics (SmPC) on the Medicines and Healthcare products Regulatory Agency website at https://products.mhra.gov.uk/. About Attruby™ (acoramidis)INDICATIONAttruby is a transthyretin stabilizer indicated for the treatment of the cardiomyopathy of wild-type or variant transthyretin-mediated amyloidosis (ATTR-CM) in adults to reduce cardiovascular death and cardiovascular-related hospitalization. IMPORTANT SAFETY INFORMATIONAdverse ReactionsDiarrhea (11.6% vs 7.6%) and upper abdominal pain (5.5% vs 1.4%) were reported in patients treated with Attruby versus placebo, respectively. The majority of these adverse reactions were mild and resolved without drug discontinuation. Discontinuation rates due to adverse events were similar between patients treated with Attruby versus placebo (9.3% and 8.5%, respectively). About BridgeBio Pharma, Inc.BridgeBio Pharma, Inc. (BridgeBio) is a new type of biopharmaceutical company founded to discover, create, test, and deliver transformative medicines to treat patients who suffer from genetic diseases. BridgeBio’s pipeline of development programs ranges from early science to advanced clinical trials. BridgeBio was founded in 2015 and its team of experienced drug discoverers, developers and innovators are committed to applying advances in genetic medicine to help patients as quickly as possible. For more information visit bridgebio.com and follow us on LinkedIn, Twitter, Facebook, and YouTube. About HealthCare RoyaltyHealthCare Royalty (HCRx) is a leading royalty acquisition company focused on commercial or near-commercial biopharmaceutical products. With offices in Stamford, Conn., San Francisco, Boston, London and Miami, HCRx has invested $5+ billion in over 90 biopharmaceutical products since inception. For more information, visit https://www.hcrx.com. HEALTHCARE ROYALTY® and HCRx® are registered trademarks of HealthCare Royalty Management, LLC. About Blue OwlBlue Owl (NYSE: OWL) is a leading asset manager that is redefining alternatives®.With $273 billion in assets under management as of March 31, 2025, we invest across three multi-strategy platforms: Credit, Real Assets, and GP Strategic Capital. Anchored by a strong permanent capital base, we provide businesses with private capital solutions to drive long-term growth and offer institutional investors, individual investors, and insurance companies differentiated alternative investment opportunities that aim to deliver strong performance, risk-adjusted returns, and capital preservation. Together with over 1,200 experienced professionals globally, Blue Owl brings the vision and discipline to create the exceptional. To learn more, visit www.blueowl.com. BridgeBio Pharma, Inc. Forward-Looking StatementsThis press release contains forward-looking statements. Statements in this press release may include statements that are not historical facts and are considered forward-looking within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which are usually identified by the use of words such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “hopes,” “intends,” “may,” “plans,” “potential,” “projects,” “seeks,” “should,” “will,” and variations of such words or similar expressions. BridgeBio intends these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act. These forward-looking statements, including statements regarding the potential commercial performance of BEYONTTRA in Europe and other global markets; the anticipated benefits of the royalty monetization agreement with HCRx and Blue Owl Capital; BridgeBio’s expectations for the launch and market uptake of Attruby and BEYONTTRA; the belief in acoramidis’ ability to positively impact the lives of patients with ATTR-CM; and the expected use of proceeds to support BridgeBio’s pipeline of genetic medicines, reflect BridgeBio’s current views about its plans, intentions, expectations, and strategies, which are based on information currently available and assumptions it has made. Although BridgeBio believes that its plans, intentions, expectations, and strategies as reflected in or suggested by these forward-looking statements are reasonable, it can give no assurance that such plans, intentions, expectations, or strategies will be attained or achieved. Furthermore, actual results may differ materially from those described in the forward-looking statements and will be affected by a number of risks, uncertainties, and assumptions, including, but not limited to: BridgeBio’s dependence on third parties for development or commercialization activities; regulatory authorities requiring additional studies or data to support the continued or expanded commercialization of acoramidis; whether data and results meet applicable regulatory requirements or are sufficient for continued development, review, or approval; and whether other regulatory agencies agree with BridgeBio’s strategies or data interpretations. These risks also include impacts from global health emergencies, such as delays in regulatory reviews and other activities, manufacturing and supply chain interruptions, adverse effects on healthcare systems, and disruption of the global economy; and the impacts of macroeconomic and geopolitical events, including changing conditions from hostilities in Ukraine and in Israel and the Gaza Strip, increasing inflation rates, and fluctuating interest rates on BridgeBio’s operations and expectations. Additional risks are described in the “Risk Factors” section of BridgeBio’s most recent Annual Report on Form 10-K, Quarterly Report on Form 10-Q, and other filings with the U.S. Securities and Exchange Commission. Moreover, BridgeBio operates in a highly competitive and rapidly evolving industry in which new risks may emerge from time to time. These forward-looking statements are based upon the current expectations and beliefs of BridgeBio’s management as of the date of this press release and are subject to certain risks and uncertainties that could cause actual results to differ materially from those described in these statements. Except as required by applicable law, BridgeBio assumes no obligation to publicly update any forward-looking statements, whether as a result of new information, future events, or otherwise. BridgeBio Media Contact:Bubba Murarka, Executive Vice Presidentcontact@bridgebio.com (650)-789-8220 BridgeBio Investor Contact:Chinmay Shukla, Senior VP Strategic Financeir@bridgebio.com

Archimedes Vascular Announces Close of Series A Financing led by Sherpa Healthcare Partners and Appoints Raymond W. Cohen as Chairman of its Board of Directors

BIRMINGHAM, Ala. and BEIJING, June 23, 2025 /PRNewswire/ — Archimedes Vascular, Inc., a pre-clinical stage medical device company developing an implant for the treatment of severe hypertension announced a $2.2 million Series A financing led by Sherpa Healthcare Partners. In conjunction…

Kestra Medical Technologies Announces Inclusion in the Russell 2000® and Russell 3000® Indexes

KIRKLAND, Wash., June 23, 2025 (GLOBE NEWSWIRE) — Kestra Medical Technologies, Ltd. (Nasdaq: KMTS), a wearable medical device and digital healthcare company, today announced that the company will be added to the Russell 3000® Index, with automatic inclusion in the Russell 2000® Index, effective after the U.S. market close on June 27. The annual reconstitution of the Russell indexes captures the 4,000 largest U.S. stocks as of April 30, ranking them by total market capitalization. Membership in the U.S. all-cap Russell 3000® Index results in automatic inclusion in the large-cap Russell 1000 Index or small-cap Russell 2000 Index and the appropriate growth and value style indexes. Russell indexes are widely used by investment managers and institutional investors for index funds and as benchmarks for active investment strategies. Approximately $10.6 trillion in assets are benchmarked against the Russell U.S. indexes. “We are honored to be included in the Russell indexes,” said Brian Webster, President and CEO of Kestra Medical Technologies. “The inclusion of Kestra in the Russell indexes following our March 2025 initial public offering is a significant milestone in our public company journey. As we continue to expand our presence across markets, we remain focused on protecting more patients at risk of sudden cardiac arrest and creating long-term value for our shareholders.” About KestraKestra Medical Technologies, Ltd. is a commercial-stage wearable medical device and digital healthcare company focused on transforming patient outcomes in cardiovascular disease using monitoring and therapeutic intervention technologies that are intuitive, intelligent, and connected. For more information, visit www.kestramedical.com. CONTACT: Investor contact

Neil Bhalodkar

neil.bhalodkar@kestramedical.com

Media contact

Rhiannon Pickus

rhiannon.pickus@kestramedical.com

Galaxy Therapeutics Appoints Neurovascular Industry Expert, Dr. Michael Alexander, as Chief Medical Officer

Newest Addition in Line with the Company’s Stated Goal of Expanding its Clinical and Scientific Teams as it Progresses Development and Ultimate Commercialization of its SEAL™ Device to Treat Brain Aneurysms MILPITAS, Calif. , June 18, 2025 /PRNewswire/ — Galaxy Therapeutics, a privately…

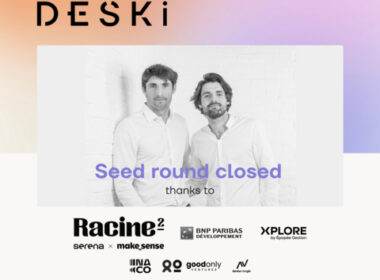

DESKi Closes $6M Seed Round to Bring AI-Powered Heart Scans to Market

BORDEAUX, France–(BUSINESS WIRE)–DESKi, a healthtech company developing AI-powered diagnostic tools in collaboration with clinicians and researchers, today announced the close of a $6 million seed round to support the U.S. and global market launch of its FDA-approved cardiac imaging software, HeartFocus. “This funding moves us one step closer to a world […]

Lilly to acquire Verve Therapeutics to advance one-time treatments for people with high cardiovascular risk

Verve’s leading programs aim to deliver lifelong cardiovascular risk reduction with a single dose by targeting genes strongly linked to cardiovascular disease Lilly’s established capabilities in cardiometabolic disease and genetic medicines are highly complementary to Verve’s vision and…

Corvia Medical closes $55 million funding round to complete confirmatory trial and pursue FDA approval of Corvia Atrial Shunt

Existing investors provide funding to finish international RESPONDER-HF trial TEWKSBURY, Mass., June 17, 2025 /PRNewswire/ — Corvia Medical, Inc, a company dedicated to transforming the treatment of heart failure, today announced the successful closure of a $55 million funding round from…

Catheter Precision (VTAK) Reports Key Progress for the LockeT Product

FORT MILL, S.C., June 12, 2025 (GLOBE NEWSWIRE) — Catheter Precision, Inc. (VTAK – NYSE/American), a US based medical device company focused on developing technologically advanced products for the cardiac electrophysiology market announced that LockeT sales for Q2 2025 are on track to be the highest to date. Second quarter 2025 LockeT sales are already outpacing Q2 2024 sales with a 200% increase.